Salesforce financial cloud was launched a couple of years ago by Salesforce for wealth management companies and organizations. It is quite an extension of its NPS o Non-Profit stacker pack, except that here the focus is on financial sector services. The service is available only with a Lightning version of Salesforce CRM.

Financial service cloud intends to help banks, financial institutions, and banks in managing their client assets, financial accounts, liabilities, and much more. For the wealth organizations, it is quite a beneficial feature and service, and today through this post, we are going to explore the financial cloud of Salesforce.

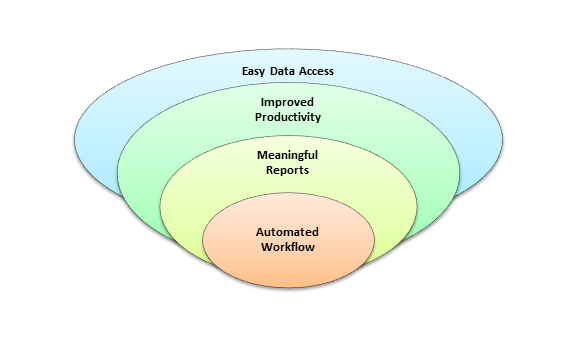

Wealth management companies usually require almost the same set of functionalities to manage their operations. Salesforce provides almost all basic essential such features through its Financial cloud. As a result, the wealth management companies have to spend less time building fundamental components, and more time they can spend their business operations and adding new custom functionalities to their business. Some of the foundational components that are offered by Salesforce are:

In addition to the features listed above the Salesforce financial service clouds also includes a slick pre-built Einstein Analytic app with which both the advisors and executives can get help. Moreover, the teams can also analyze their business books instantly to determine their helpful actions.

Apart from being simple, just an information aggregator, Salesforce financial cloud service cloud can put everything streamlined by keeping the client in the center. As a result, the consultants, advisors, and managers can make intelligent business decisions quickly and appropriately.

For every financial organization that is planning to move to the Salesforce Financial Cloud, certain aspects must be considered by them, and they are listed below:

i). Just know and determine the level of required Salesforce customization for your organization. As you can access Salesforce financial service cloud if and only if you have implemented Lightning, so check for Lightning Readiness that can be performed automatically?

ii). Know that the number of Javascript buttons, objects, APEX classes, triggers, and validation rules that you have. It may take a significant amount of time to analyze complete information that may vary ranging from 6 months to one year. Some organizations prefer to install Financial Service Cloud in Lightning-enabled environment and for the organizations that are already using Lightning can directly start using Financial Service Cloud as well.

iii). Financial Service companies typically have the most critical requirement of security aspects. By considering the most required security aspects for your organization, prepare the required data model that can satisfy all security-related requirement.

iv). Salesforce financial cloud can divide the client accounts into four categories they are listed below:

v). Make your data migration plan ready, and your implementation team must understand that plan properly. They must know the data model and all underlying complexities around the existing Account structure. Fundamentally it is different from the standard Salesforce, so take proper time in evaluating this part.

vi). Check the roadmap of Salesforce financial service cloud product. Salesforce always takes the feedback from its clients and keep on adjusting the platform as per their requirement. For this, your Salesforce Account executive will have the most up to date information.

So this is all you must know before moving to Salesforce Financial Service Cloud. Now let us understand some of the common benefits of Salesforce financial service cloud. In our next section, we are going to discuss them one by one.

There are certain advantages of this newly launched Salesforce Financial Service Cloud, and they are listed below:

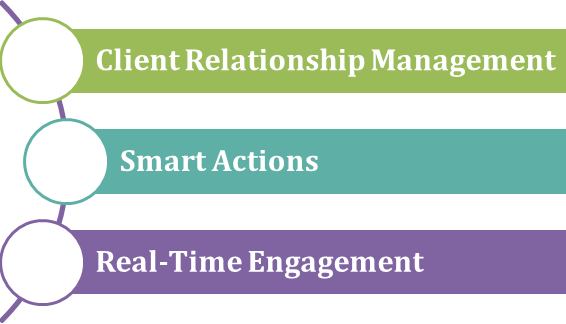

a). Defined and Deep Client Relationship Management

With the help of Salesforce Financial Service Cloud, any advisor can easily build and maintain an engaging relationship with their clients for that they can use the data models or business processes. Advisors can move beyond managing the single client relationship up to managing the full family-wise accounts and integrating even third party application to manage that relationship.

b). Smart Actions

Most financial advisors rely on paper-based SOP or Standard Operating Procedure to maintain compliance and increase productivity, but the clients are expecting more interactive and social experience in comparison to a traditional phone. The advisors can proactively manage their financial client goals and effectively grow their business.

c). Real-Time Client Engagement

The businesses may have their traditional clients, but along with that, they may also have some new generation clients that may expect more technology-driven interaction. They may expect your presence on mobile apps, intuitive information access, better self-service capabilities, and more transparency. With the help of Salesforce Financial service cloud, the agents can communicate with their clients on their suitable and preferred channel and provide them real-time information as well.

In this way, they can provide more relevant information to their clients in the right context. They can also know about email or paper-based transactions as well. As today many customers expect more transparency from the firms that are managing their wealth, so the businesses have to put extra efforts in providing them with a detailed and transparent view of their details. Salesforce Financial Service cloud can help the organizations in this regard.

By understanding the client background and understanding their expectation for their financial exposure, the agents can easily build the right relationship with their clients and get the right advice to make better business decisions. They can provide the service to their client’s family as well along with. They can get a complete view of the client’s portfolio and provide them with appropriate service.

Finally, it can be said that Salesforce Financial Model is being used by financial organizations like banks, finance firms, and wealth management organizations, including many others. As it can only be implemented on the Lightning platform, so for the users, it is always advisable that check your organization for Lightening readiness and then start thinking to use Salesforce Financial Cloud. It can provide real-time and most up to date client information.

Stop, read and acquire deep insights into complex issues

© 2025 Copyright - JanBask.com | Designed by - JanBask Digital Design

Write a Comment