Here’s the problem most financial advisors are dealing with right now. Their clients want investment strategies that actually fit their unique situations, their goals, how much risk they can stomach, and where they are in life. But trying to deliver that kind of personalization to dozens or hundreds of clients? It’s been practically impossible.

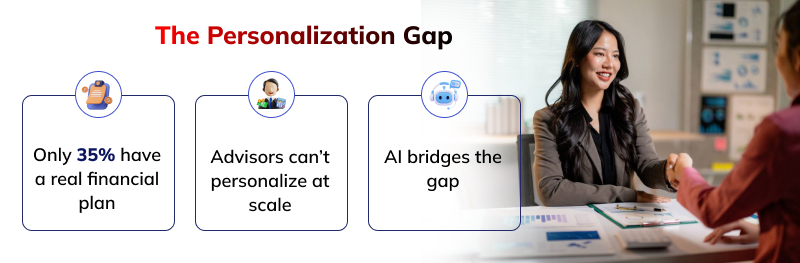

Consider this: only 35% of Americans have a real financial plan, even though most people say they want one. The traditional approach isn’t working. Annual portfolio reviews, manually crunching numbers for hours, generic recommendations that sort of fit everyone and no one at the same time. Markets move fast. The client needs a change. And advisors are stuck trying to keep up.

That’s where AI for financial advisors comes in. AI in investing can process massive amounts of client data almost instantly, which means advisors can finally build investment strategies that are genuinely personalized and actually stay relevant as things change. It’s not about replacing the advisor. It’s about giving them tools that let them do what they do best, without the impossible workload.

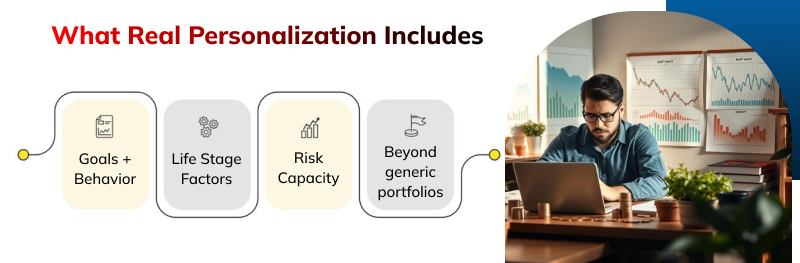

Before diving into how AI helps, it’s important to understand what genuine investment personalization actually looks like. Most advisors know their clients deserve tailored strategies, but traditional methods make it nearly impossible to deliver at scale.

Real investment personalization means building strategies that reflect how someone actually lives, their financial goals, behavioral patterns, life stage, and even how they react when markets get volatile. A 35-year-old entrepreneur saving for retirement has completely different needs than a 50-year-old executive planning for college tuition. Cookie-cutter portfolios based solely on age and risk tolerance miss the bigger picture.

Genuine personalization also means staying current. Markets shift constantly. Clients get promotions, have kids, inherit money, or face unexpected medical bills. Investment strategies need to adjust in real time, not just once a year during review season. That’s where AI in financial planning makes a real difference, by continuously monitoring both market conditions and individual client circumstances.

Manual analysis takes too long and can only go so deep. By the time an advisor finishes a comprehensive portfolio review, the data’s already outdated. Annual check-ins miss critical moments when clients actually need guidance. The real bottleneck? Advisors are forced to choose between delivering deep personalization to a handful of clients or spreading themselves thin across a larger book of business. AI in investing removes that impossible trade-off.

This is where things get practical. AI for financial advisors doesn’t just speed up existing processes; it fundamentally changes what’s possible when building investment strategies for individual clients.

AI systems can process a client’s complete financial picture in minutes: income streams, asset allocation, spending habits, debt obligations, savings patterns, and long-term goals. But it goes further than that. These tools build dynamic profiles that track how clients actually behave with money over time.

They spot planning gaps that might take a human advisor hours to identify, like an underfunded emergency fund paired with aggressive growth investments, or tax inefficiencies that are slowly eating away at returns. This comprehensive analysis creates the foundation for recommendations that actually fit each person’s financial reality.

Here’s where AI in investing really shows its value. Instead of waiting for quarterly or annual reviews, AI monitors portfolios continuously. When market conditions shift or a client’s situation changes, maybe they switch jobs or suddenly need liquidity—the system can flag necessary adjustments immediately.

This isn’t about making automatic trades without oversight. It’s about giving advisors real-time intelligence so they can be proactive instead of reactive. Portfolios stay aligned with client goals as life happens, not just when the next scheduled review rolls around.

AI in investment strategies goes beyond numbers. These systems analyze how individual clients respond to market stress, do they panic sell during downturns, or do they stay the course ? Do they consistently overspend in certain categories, creating cash flow issues that affect their ability to invest?

By identifying these behavioral patterns, AI provides advisors with early warning signals. If a client’s spending suddenly spikes or they’re checking their portfolio obsessively during a market dip, advisors can reach out before emotional decisions derail long-term plans. The investment strategy itself can be adjusted to account for these psychological factors, maybe more stable assets for anxious clients, or structured withdrawal plans for those prone to overspending.

AI for wealth management shines when dealing with diverse client segments. Younger investors might need strategies that balance student loan repayment with early retirement contributions and credit building. Middle-income families juggle competing priorities, saving for kids’ college, buying a home, and building retirement funds.

Women often face unique financial challenges: career interruptions, longer lifespans, and wage gaps that affect long-term savings. High-net-worth clients need sophisticated tax optimization and estate planning woven into their investment approach. AI can model all these variables simultaneously and generate strategies that address each client’s specific circumstances.

AI doesn’t just react to current situations; it forecasts what’s coming. By analyzing life stage patterns and financial trajectories, these systems can predict when clients will need major strategy adjustments. Someone in their late 40s might need to shift focus from pure growth to income generation soon. A young family’s expenses will likely spike when kids hit college age.

AI in investing also processes real-time market data to identify opportunities that align with specific client goals. Instead of generic market insights, advisors get actionable intelligence tailored to each portfolio they manage. This forward-looking approach transforms advisors from reactive consultants into proactive strategists.

Understanding the theory is one thing. Here’s how advisors are actually applying AI to personalize investment strategies in their day-to-day practice.

AI systems analyze a client’s complete profile, goals, timeline, risk capacity, tax situation, and recommend specific investment products that genuinely fit. This isn’t random fund selection. It’s data-driven matching that considers dozens of variables simultaneously. According to recent surveys, 50% of financial advisors see this as one of the highest-value applications of AI. Clients notice the difference when recommendations feel tailored specifically to their situation rather than pulled from a standard menu.

Creating a comprehensive financial plan used to take days. AI for wealth management has compressed that timeline dramatically. These systems generate detailed, personalized plans based on individual circumstances, and they don’t just create static documents. As client data updates or market conditions change, the plans adjust automatically. Nearly half of the advisors surveyed identified this capability as high-value, mainly because it frees up time for actual client conversations instead of spreadsheet work.

AI handles portfolio rebalancing with precision that’s hard to match manually. The system continuously monitors whether allocations still match client objectives and triggers rebalancing when needed, not on an arbitrary schedule. It also identifies tax-loss harvesting opportunities that improve after-tax returns without changing the overall strategy. About 48% of advisors consider this a critical AI application, particularly for clients with complex portfolios.

Market research that used to consume hours now happens in minutes. AI in investing processes massive datasets, identifies relevant trends, and surfaces insights specific to each client’s portfolio. Advisors get tailored intelligence instead of generic market commentary. This means they can back up personalized recommendations with solid data without sacrificing time that should be spent with clients.

The shift toward AI-powered personalization is already happening. Recent data shows 96% of financial advisors believe AI can fundamentally change how they serve clients, and 97% expect the biggest impact within the next three years.

AI for financial advisors makes it possible to deliver personalized investment strategies that used to require dedicated teams. Technology handles data processing and continuous monitoring while advisors focus on what requires human judgment, understanding client emotions, navigating life transitions, and building trust.

The firms winning new business aren’t necessarily the biggest. They’re the ones using technology to deliver better, more personalized service at scale. For financial institutions looking to implement AI in wealth management, partnering with experienced AI consulting services can ensure smooth adoption. JanBask helps financial firms integrate AI solutions that enhance personalization without disrupting existing workflows.

Stop, read and acquire deep insights into complex issues

© 2025 Copyright - JanBask.com | Designed by - JanBask Digital Design

Write a Comment